nj employer payroll tax calculator

Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3 and WR-30. New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to calculate net take home pay for either hourly or salary employment.

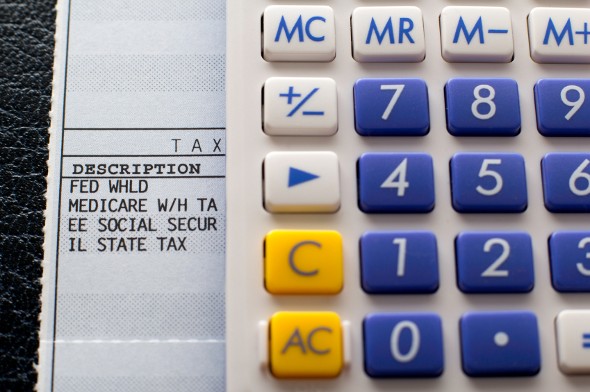

Understanding Payroll Taxes And Who Pays Them Smartasset

Use the New Jersey paycheck calculators to see the taxes on your paycheck.

. Ad Process Payroll Faster Easier With ADP Payroll. Enter your info to see. Just enter in the required info below.

New Jersey Paycheck Calculator - SmartAsset SmartAssets New Jersey paycheck calculator shows your hourly and salary income after federal state and local taxes. New Jersey new employer rate. Figure out your filing status work out your adjusted gross income Total.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. However employees disability insurance and family. Get Started With ADP.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey. Ad Compare This Years Top 5 Free Payroll Software. New Jersey Tax Information.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. 2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. 35300 2020 Taxable Wage Base TDI FLI workers only.

Discover ADP For Payroll Benefits Time Talent HR More. Discover ADP For Payroll Benefits Time Talent HR More. Employees unemployment and workforce development wage base increase to 36200 maximum withholding 15385.

The withholding tax rates for 2022 reflect graduated rates from 15 to 118. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Get Started With ADP.

Employer Payroll Tax Electronic Filing and Reporting Options. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Commuter Transportation Benefit Limits.

Employer Requirement to Notify Employees of Earned Income Tax Credit. Hourly Payroll Calculator Use this calculator for employees who are paid hourly. After a few seconds you will be provided with a full breakdown.

11 to 28 for 2021. The standard FUTA tax rate is 6 so your. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator.

Select the Hourly option under Pay Type enter the employees pay details and watch the. The 118 tax rate applies to individuals with taxable. File and Pay Employer Payroll Taxes Including 1099 1095.

New Jersey new employer. Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks.

New Jersey Gross Income Tax. 134900 In accordance with NJAC. Free Unbiased Reviews Top Picks.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Withhold 62 of each employees taxable wages until they earn gross pay. Ad Compare This Years Top 5 Free Payroll Software.

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms W2 Forms

2021 New Jersey Payroll Tax Rates Abacus Payroll

What Is Fica Tax Contribution Rates Examples

What Are Employer Taxes And Employee Taxes Gusto

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified

2020 New Jersey Payroll Tax Rates Abacus Payroll

What Are Employer Taxes And Employee Taxes Gusto

Futa Tax Overview How It Works How To Calculate

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Free New York Payroll Calculator 2022 Ny Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

State W 4 Form Detailed Withholding Forms By State Chart

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal Payroll Tax Rates Abacus Payroll

Employer Payroll Tax Calculator Incfile Com

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is Local Income Tax Income Tax Income Tax