does instacart take taxes out of paycheck

You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

That means youd only pay income tax on 80 of your profits.

. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Does Instacart take taxes out. Social Security tax is 124 of your pay.

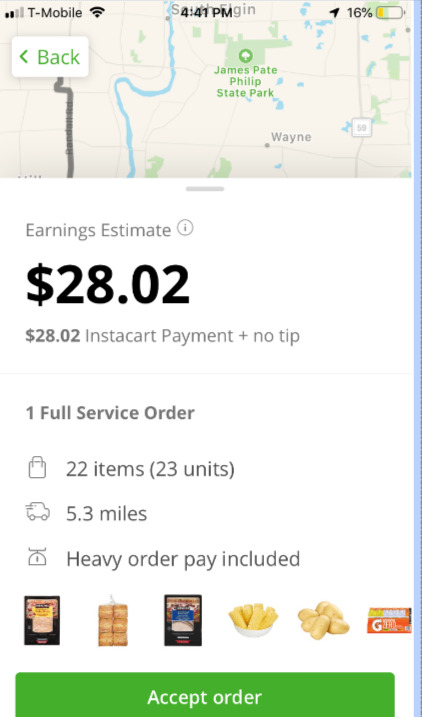

Our analysis of more than 1400 samples of pay data provided by instacart workers across the country finds that the average instacart worker is paid just 766hour after accounting for the costs of mileage and additional payroll taxes borne by independent. They do still pay for heavy items as of today but I expect that will go away as well. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

If you are looking for a hands-off approach to dealing with your Instacart 1099 taxes try Bonsais 1099 expense tracker to organize your tax deductions online. This is very common for gig apps and jobs like DoorDash or Uber Eats use the exact same payment method. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file.

What taxes do full-service shoppers have to pay. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier. Its a completely done-for-you solution that will help you track and.

W-2 employees also have to pay FICA taxes to the tune of 765. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Does Instacart take taxes out of paycheck.

You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. Thankfully you wont need to pay taxes on everything you earn from Instacart.

However this amount is blended into the overall pay from Instacart and in some jobs the pay thats supposedly for mileage actually makes up the largest part of what Instacart pays. So for every thousand dollars you earn the government gets 124 for Social Security and 29 for Medicare totalling 153. There are a few different taxes involved when you place an order.

Should I just save half of my pay. The estimated rate accounts for Fed payroll and income taxes. If you pay attention you might have noticed they dont take that much out of your paycheck.

Instacart does not take out taxes for independent contractors. Plan ahead to avoid a surprise tax bill when tax season comes. Heres how it works.

You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Since full-service shoppers are considered independent contractors they may have to make estimated quarterly tax payments.

This implies you need to cover all your own costs and pay your own taxes. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. Along these lines the time-based compensation you procure from Instacart wont be the final sum you clear after taxes.

But if you choose to work as an Instacart full-service shopper you will need to withhold and pay your own taxes as well as self-employment taxes. If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. For example you can deduct the cost of using your vehicle for business by claiming actual expenses or using the standard mileage deduction.

Unlike in-store shoppers Instacart delivery drivers have to pay self-employment tax. Medicare is 29 of your pay. This is a standard tax form for contract workers.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. The amount they pay is matched. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS.

I worked for Instacart for 5 months in 2017. So you get social security credit for it when you retire. Also known as FICA tax its how freelancers and independent contractors contribute to Social Security and Medicare.

Because taxes are not withheld from their pay most independent contractors are responsible for making quarterly tax payments based on their estimated annual income. To pay your taxes youll generally need to make quarterly tax payments estimated taxes. Tax withholding depends on whether you are classified as an employee or an independent contractor.

As an Instacart customer you are an independent temporary worker. Alternatively you can use the Instant Cash Out feature to get. Curiously Instacart lists pay of 60 per mile for the miles from store to delivery two cents more than the IRS rate.

The gas and maintenance on your vehicle is part of the base amount of 700. Independent contractors can claim business expenses to reduce their taxable income. Because instacart shoppers are contractors the company will not take taxes out of your paycheck.

Does Instacart pay mileage. Side note Im an idiot who didnt want to pay taxes out of pocket so I canceled 10 Instahours and decided to Instaquit. Does Instacart take out taxes for its employees.

Instacart can pay you slightly earlier depending on how fast funds clear and reach your bank account but typically Wednesday is the day of the week payments actually arrive. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Deductions are important and the biggest one is the standard mileage deduction so keep track of.

Thats because Instacart doesnt withhold taxes from earnings like it does for part-time employees. It also does not pay by item so you can get a batch of 8 items for 700 or 88 items and more for 700.

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me A Contracted Employee S Guide

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Pay Stub How To Get One Other Common Faqs

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

When Does Instacart Pay Me A Contracted Employee S Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

How Much Can You Make A Week With Instacart 2022 Real Earnings

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery